The following is a write-up of a number of conversations and work done together between Kip Twitchell and Steve Turner in the mid 2010’s that would qualify as a Sharealedger.org discussion, and spurred the creation of the organization

How to Measure Corporate Value

Ledgers help us measure things, particularly over time. But ledgers can be used to measure anything, from migratory patterns of Canadian Lynx, to a child’s piggy bank savings. How to decide what to measure is an important topic. We tend to try to improve whatever we measure, so we better measure the right things.

A number of years ago Steve Turner reached out to me as he was doing research on William McCarthy’s REA theory, Resources, Events and Agents. The conversations with him over the years were insightful to me in thinking about this problem.

A couple of years later, Steve and his partners created a method for evaluating what companies measure, called Enterprise Value Integration or EVI. The basis of EVI seems particularly relevant today as major corporate CEOs have started to question how to measure the effectiveness of the corporation.

For example, The New York Times reported on August 19, 2019 that a group of CEOs from the largest corporations in the US say shareholder value is not longer everything.

Shareholder Value Is No Longer Everything, Top C.E.O.s Say

Aug. 19, 2019

Nearly 200 chief executives, including the leaders of Apple, Pepsi and Walmart, tried on Monday to redefine the role of business in society — and how companies are perceived by an increasingly skeptical public.

Breaking with decades of long-held corporate orthodoxy, the Business Roundtable issued a statement on “the purpose of a corporation,” arguing that companies should no longer advance only the interests of shareholders. Instead, the group said, they must also invest in their employees, protect the environment and deal fairly and ethically with their suppliers.

“While each of our individual companies serves its own corporate purpose, we share a fundamental commitment to all of our stakeholders,” the group, a lobbying organization that represents many of America’s largest companies, said in a statement. “We commit to deliver value to all of them, for the future success of our companies, our communities and our country.”

The shift comes at a moment of increasing distress in corporate America, as big companies face mounting global discontent over income inequality, harmful products and poor working conditions.

….

The Business Roundtable did not provide specifics on how it would carry out its newly stated ideals, offering more of a mission statement than a plan of action. But the companies pledged to compensate employees fairly and provide “important benefits,” as well as training and education. They also vowed to “protect the environment by embracing sustainable practices across our businesses” and “foster diversity and inclusion, dignity and respect.”

It was an explicit rebuke of the notion that the role of the corporation is to maximize profits at all costs — the philosophy that has held sway on Wall Street and in the boardroom for 50 years. Milton Friedman, the University of Chicago economist who is the doctrine’s most revered figure, famously wrote in The New York Times in 1970 that “the social responsibility of business is to increase its profits.”

This mind-set informed the corporate raiders of the 1980s and contributed to an unswerving focus on quarterly earnings reports. It found its way into pop culture, when in the 1987 movie “Wall Street,” Gordon Gekko declared, Greed is good. More recently, it inspired a new generation of activist investors who pushed companies to slash jobs as a way to enrich themselves.

“The ideology of shareholder primacy has contributed to the economic inequality we see today in America,” Darren Walker, the president of the Ford Foundation and a Pepsi board member, said in an interview. “The Chicago school of economics is so embedded in the psyche of investors and legal theory and the C.E.O. mind-set. Overcoming that won’t be easy.”

The Business Roundtable included its own articulation of the theory in an official doctrine in 1997, writing that “the paramount duty of management and of boards of directors is to the corporation’s stockholders.” Each version of its principles published over the last 20 years has stated that corporations exist principally to serve their shareholders.

But by last year, the Business Roundtable’s language was out of step with the times. Many chief executives, including BlackRock’s Larry Fink, had begun calling on companies to be more responsible. Businesses were pledging to fight climate change, reduce income inequality and improve public health. And at gatherings like the World Economic Forum in Davos, Switzerland, the discussions often centered on how businesses could help solve thorny global problems.

“The threshold has moved substantially for what people expect from a company,” Klaus Schwab, the chairman of the World Economic Forum, said in an interview. “It’s more than just producing profits for the shareholders.”

Last year, Jamie Dimon, the chief executive of JPMorgan Chase and the chairman of the Business Roundtable, began an effort to update its principles. “We looked at this thing that was written in 1997 and we didn’t agree with it,” Mr. Dimon said in an interview. “It didn’t fairly describe what we think our jobs are.”

Mr. Dimon proposed making a formal revision to the annual statement at a Business Roundtable board meeting in Washington this spring. It then fell to Alex Gorsky, the chief executive of Johnson & Johnson, who runs the group’s governance committee, to create the language.

“There were times when I felt like Thomas Jefferson,” Mr. Gorsky said in an interview….

Thomas Kaplan contributed reporting and Sheelagh McNeill contributed research.

My Experience

In my own experience in the corporate world, I could see the impact of what Steve was explaining to me. In the mid 2000, a CEO announced plans to double the earnings per share in a year. After the year, when the goal was accomplished, it was so well received he outlined a plan to increase it multiple fold to $20 a share by 2015.

I watched what happened in the organization as this goal was focused on deeply. While sitting in Japan listening to an expert on focusing on customers, I drafted the following slide based upon what I was seeing happen.

In November 2013, in response to a company employee survey, I added the following slide.

As an example of how I feel I partially fund [shareholders], the per diem allocation for meals pretty consistently does not cover the cost of meals in the areas I work. After a few complaints by my wife about exceeding it consistently, I have taken to carrying food with me, and for the last four months I likely make two meals a week from this supply. Below is the food in my backpack today (11/6/2013), to give a sense of the way I eat.

As another example, I have spent 61 hours in coach in the last two and a half weeks, (13 hours to DFW to Japan, 11 hours to Amsterdam, 11 hours to Dallas, 3 hours to Las Vegas, 6 hours to Mexico City). I can’t fathom my company paying for anything else. As I have explained that to 3 other people who do not work for my company, they have all encouraged me to find some place else to work.

Mutual Pain

In considering this post, I thought about using the title “I work for Customers, and am Enabled by Shareholders.” Yet the last line sticks in my mouth; so much of the bad behavior in our financial markets can be viewed as caused by everyone whipping the person standing next to them.

It seems to start perhaps with shareholders whipping management to provide greater returns. This is done in part through pension fund managers who are demanding higher returns in order to provide for expected retirements.

Management then whips employees to do more and more with less and less.

And then, probably unwittingly for the most part, employees whip their investment advisors to provide greater returns so they can retire on the limited amounts they have saved.

What is EVI?

Steve Turner’s Enterprise Value Integration starts with the premise that it is possible for organizations to optimize for more than one Key Performance Indicators or KPIs: it is not necessary to optimize only for shareholder value, which often destroys value to customers and employees.

Check out more about EVI at the Enterprise Value Integration website.

Relationship to the Theory of Resources, Events and Agents

Some portion of Sharealedger is based upon McCarthy’s Resources, Events and Agents theory. I recorded four videos giving some sense of how I view ledgers being influenced by Enterprise Value Integration.

The first video introduces the concepts of Resources Event Agents and its application to Enterprise Value Integration.

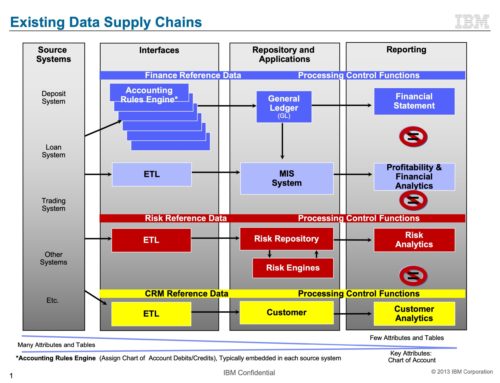

The second video compares traditional accounting system concepts to the REA ideas of Resources Event Agents and its application to Enterprise Value Integration.

The third video describes how the theoretical REA concepts must be tempered to make them practical, and outlines how to do that.

The last video in the series, outlines how to begin using REA concepts to establish better measurement systems over time, which complement, do not compete with accounting, enabling EVI analysis.